Buying your dream home isn’t just about bricks and square metres; it’s about being at a place that feels right. A home is where mornings can be slower, the coffee tastes better, and you can finally breathe a little easier. Everything feels more comforting and calming!

But before the calm, there are the struggles of going through properties, paperwork, negotiations, etc. The Auckland property market is highly competitive, and navigating open homes, auctions, and soaring prices can be challenging.

Key Points to Consider Before Buying Your Dream House!

If you are eyeing some houses for sale in Mount Eden, Auckland, and are unsure how to bring everything together, this is your calm-in-the-chaos guide.

1. Define Your Budget and Financial Comfort Zone

Knowing what you can afford is better before exploring the properties and areas. The real estate market in Auckland is very volatile, and emotional decisions can lead to long-term regrets.

To be on the safer side, start with

- Getting pre-approval from the bank or mortgage broker

- Please consider calculating additional costs such as legal fees, LIM reports, rates, insurance, and potential renovations in advance.

- Consider whether interest rates change and whether you can continue repayment.

If you are searching for houses for sale in Mt Eden, you should be willing to explore various options and analyse aspects that seem insignificant in the short term but may have a significant impact in the long run.

2. Explore the Neighbourhood and Not Just the Home

You won’t be imprisoned in your dream home for the rest of your life. A beautiful home is just half the struggle; the other half is your neighbourhood. Your neighbourhood defines your lifestyle, from commuting to coffee runs and everything in between.

Mt Eden has lovely spots, boutique cafes, stylish villas, etc. Finding the right locality can help you grow culturally and join the community. The area is near the top schools, parks, and the city centre, making it one of Auckland’s most sought-after suburbs to invest in.

The best way to determine if you like a neighbourhood is to walk around it and talk to people. A good neighbourhood can make your house feel like home!

3. Understand the Zones

In Auckland, school zones can impact property prices and resale value. Education may not be your top priority, but it will be for future buyers, which retains value for you in the long run.

Mt. Eden and Epsom are within the famous “Double Grammar Zone,” which refers to Auckland Grammar School and Epsom Girls’ Grammar School. Houses within the zoning areas attract considerable buyer competition and higher values.

When looking at houses for sale in Mount Eden, Auckland, confirm the school zone boundaries before you buy; these can change slightly each year.

4. Ask for an Inspection Report and LIM

While a home may appear perfect from the outside, it’s best to know what lies behind the paint.

A registered building inspection will check the structure, plumbing, roof, and moisture levels. At the same time, a Land Information Memorandum (LIM) report will give you council data, such as drainage, consents, and zoning restrictions.

These reports can help to detect potential problems early on so as not to risk an unexpected, more costly repair later. Spending a few hundred dollars at the start can save you thousands later.

5. Consider Commuting Times and Lifestyle

Given the challenging traffic conditions in Auckland, consider how a location aligns with your daily routine. Mt Eden offers a blend of suburban ease with city proximity. You can bike into the CBD, walk to the eateries on the Dominion Road strip, or commute from Mt Eden Station.

For families, there are parks, playgrounds, and quick access to the motorway. These benefits make for a convenient living situation while maintaining peace. On the way to an open home, give yourself time to test drive the route during the peak commuter time of 8:00. The convenience will allow you to assess if the route is realistic for your living situation.

6. Factor in Future Growth Prospects

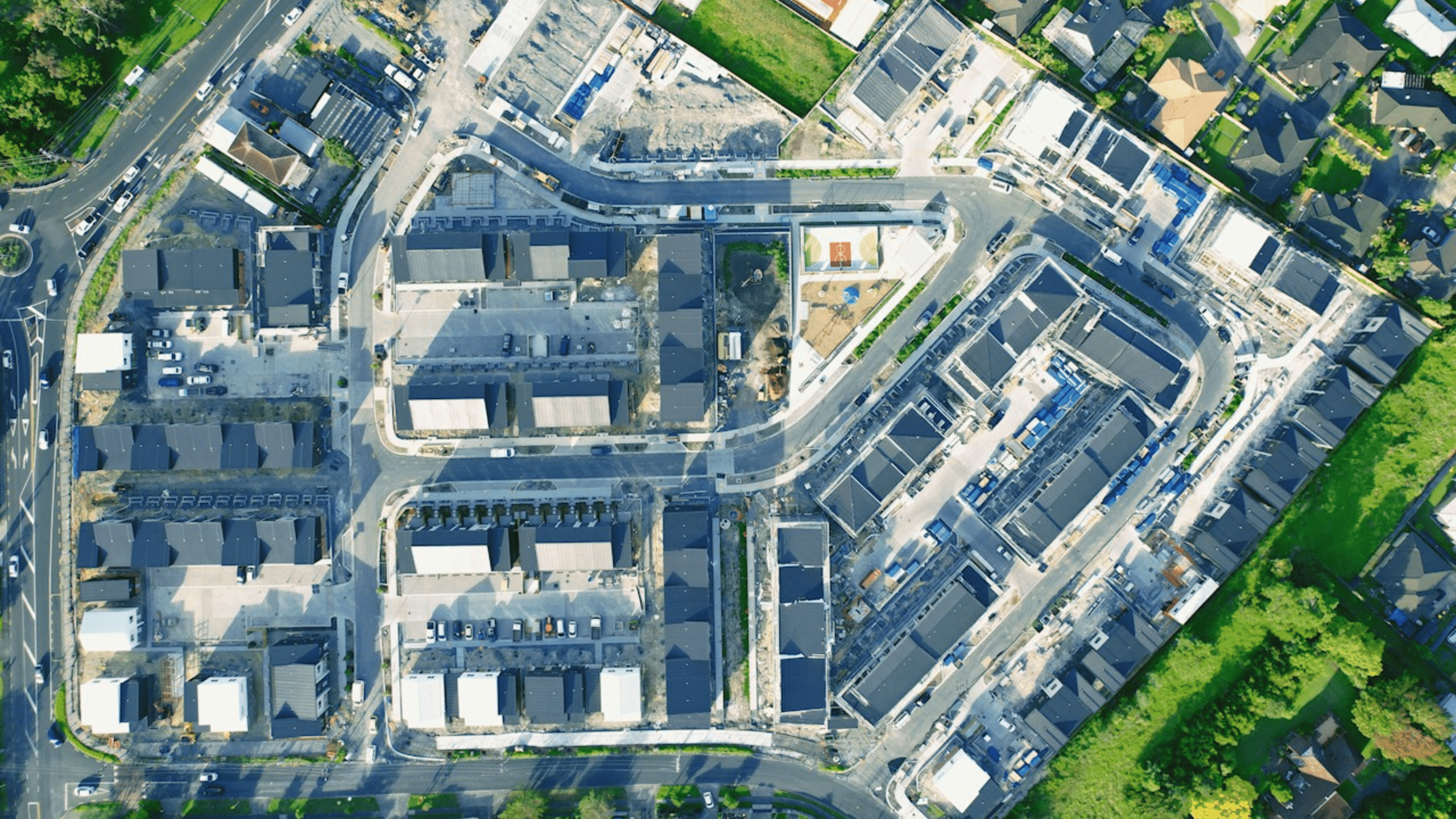

Investigate future developments, transport relationships, and zoning changes in the vicinity. An addition to the infrastructure or a new commercial project in the area can lead to improved property values (unless the new project is an unpleasant surprise). Mount Eden, for instance, is enjoying stronger targeted interest for residential property based on the City Rail Link (CRL) being on the way, which will improve commute times. When viewing real estate listings in the area, savvy buyers may consider the potential increase in value of properties near transport connections.

7. Discuss with a Local Expert

Finding your way around Auckland’s competitive market can be difficult, but a local agent can help. With a skilled expert who knows the Mt Eden and Epsom markets, you can:

– Find unlisted gems before they hit the market

– Understand the actual market value (not just the asking value)

– Negotiate on your behalf while having your interests protected!

Look for agents with strong community ties and local knowledge; you can’t underestimate someone at Ray White Mt Eden or Epsom who knows what makes these suburbs so special.

Wrapping Up!

Purchasing your ideal home in Auckland isn’t just about luck; it’s about planning, getting informed, and knowing what is important to you. For good reason, Mt Eden and Epsom are two of Auckland’s most popular suburbs: they have fantastic schools, community spirit, beautiful homes, and long-term property stability.

Before deciding, review the list below to ensure you are well-informed and confident. The right house isn’t just about the number of bedrooms and bathrooms; it is about the life you will create and the value it will bring in the coming years.