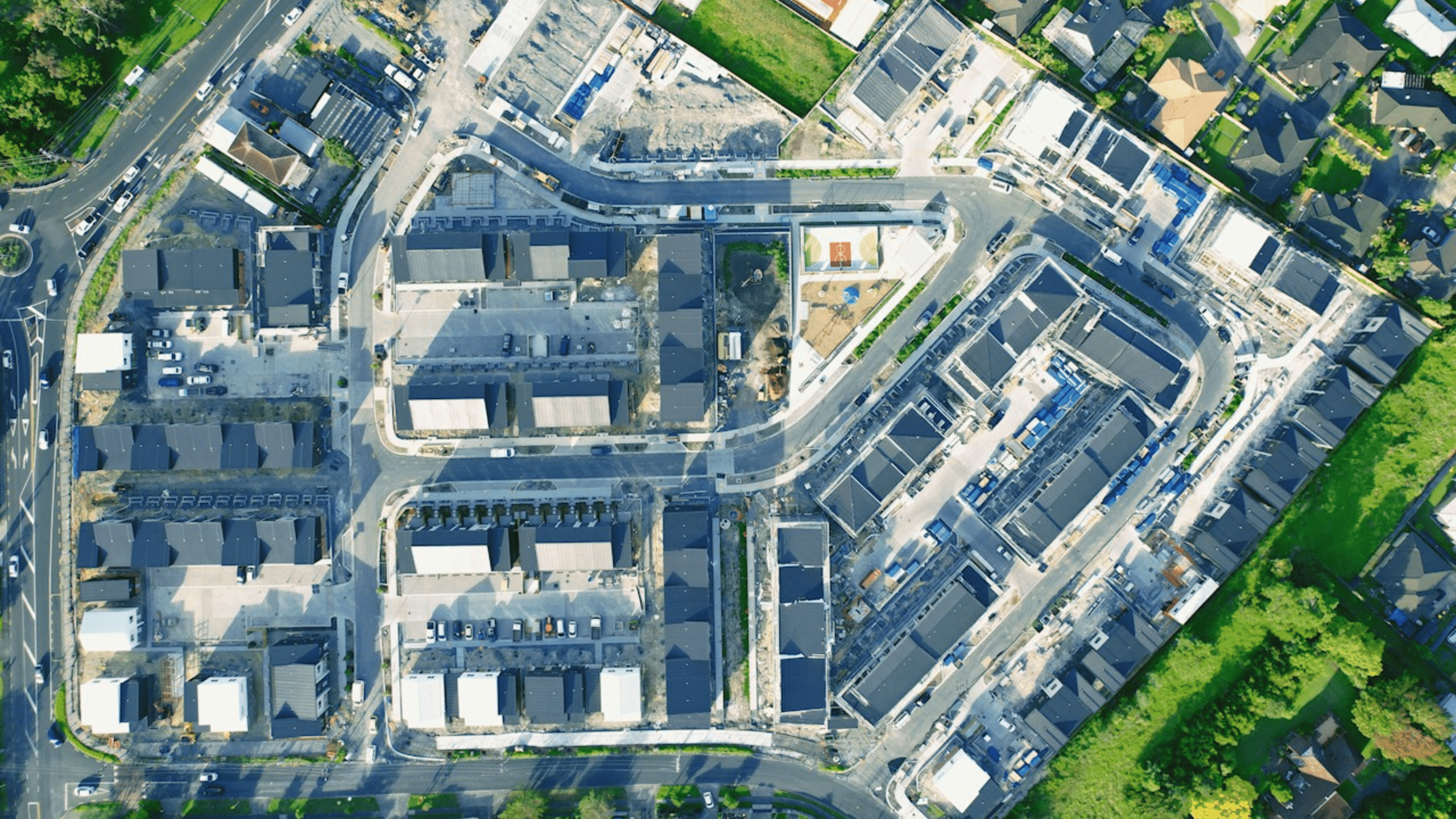

Big infrastructure projects don’t wait until opening day to affect property prices. Long before the first train runs or the last cone disappears, buyers start adjusting how they think about distance, convenience, and what feels like a safe long-term bet.

Auckland is right in the middle of that shift now. As we approach 2026, the simultaneous convergence of several major projects is already shaping assessments of value across various parts of the city.

For buyers speaking with a CBD, Morningside, or Mt Eden property specialist, the conversation has moved beyond today’s asking price. More people are looking at how access, timing, and long-term liveability are likely to shape property values over the coming years.

Why Infrastructure Affects Prices Unevenly

Transport upgrades don’t lift prices across a whole city at once. What they change first is how people move. Commutes become shorter. Travel becomes more predictable. Day-to-day life feels easier.

Over time, buyers start paying more for that convenience, but only in places where the improvement is felt in everyday routines. More minor local upgrades can make an area nicer to live in, but large-scale rapid transport tends to show up most clearly in property prices.

The Projects Doing the Heavy Lifting

The City Rail Link is the most significant shift Auckland has seen in decades. When passenger services begin in the second half of 2026, the rail network will effectively double its capacity, allowing more than 50,000 people to walk through the city centre in an hour. The most significant change isn’t just speed but reliability. Getting into town becomes easier to plan around.

The Eastern Busway, rolling out in stages through to 2027, brings that same reliability to parts of East Auckland. Dedicated lanes and new stations change how those suburbs function day to day, particularly for people who commute regularly.

Although the Central Interceptor often goes unnoticed, it plays a crucial role in enhancing wastewater capacity in the inner and western suburbs. Without it, much of the planned housing growth simply can’t happen, regardless of transport upgrades.

Together, these projects don’t just improve infrastructure. They influence where demand can grow and where price pressure is more likely to build over time.

How Projects Are Influencing Property Prices

When you look at how similar transport projects have played out in Auckland before, price changes tend to follow distance rather than suburb names.

While the figures are only indicative and speculative, based on how Northern Busway and rail‑station accessibility influenced pricing in the past, they still give you a rough idea of how the current projects could play out.

| Proximity to major rapid transit | Illustrative price impact over time |

| Within 500 metres of CRL stations | Around 5-8%, with some station-core areas reaching 19% |

| 500 metres to 1 kilometre | Generally 1-4% |

| 1 to 2 kilometres | Speculatively 0–2% at most |

| Eastern Busway station areas | Speculatively similar to other rapid‑transit stations, 3-7% |

| Areas without direct rapid-transit access | Largely tied to the broader market, often 2-6% |

These shifts don’t happen overnight. In most cases, the most precise movement occurs 12–24 months after services begin, then settles into steadier long-term growth.

In Central Auckland, this pattern is already familiar. Homes within walking distance of stations around places like Mt Eden and the inner west tend to attract more consistent interest once access improves, simply because daily life becomes easier to manage.

Why Supply Still Plays a Huge Role

Access alone doesn’t determine how prices move. Supply matters just as much.

Where transport improves, but large-scale development is limited, price pressure tends to show us steadier growth and stronger resilience. In areas with room for thousands of new homes, demand is absorbed more gradually, which can soften short-term price movement even if long-term appeal improves.

This is why changes across Auckland won’t be uniform once these projects are up and running. Some locations will feel firmer earlier, while others take longer to reflect the benefit.

Timing Heading Into 2026

Another thing buyers often underestimate is timing. Even once transport opens and planning decisions are clear, development usually trails by a year or two.

Auckland is also still working its way back from the previous market peak, and recovery has been slower here than in some other parts of the country. That means infrastructure benefits are landing in a cautious market rather than an overheated one.

With interest rates easing and population growth continuing, well-located areas tend to stabilise before momentum spreads more widely.

Final Thought: The Bigger Auckland Picture

Auckland’s infrastructure plan isn’t about sudden price hikes or dramatic overnight changes. It’s about gradually reshaping how people judge distance, convenience, and long-term practicality.

Projects like the City Rail Link and Eastern Busway won’t lift every suburb equally, but they do change where accessibility carries a premium. Over time, areas with reliable transport and limited new supply tend to hold their value better and recover sooner.

That’s why places like Mt Eden and nearby inner suburbs keep coming up as 2026 approaches. They sit where access, timing, and supply line up, and that combination usually matters over the long run.

For buyers and sellers looking ahead, understanding how infrastructure feeds into pricing is becoming just as important as understanding what the market is doing right now.