Pre-approval isn’t just a fancy letter. It’s actually your golden ticket in Auckland’s competitive property market. Without it, you’re window shopping while others are buying something for real. If you want to own your dream house, you need to get a mortgage pre-approval, and here’s how.

Why Auckland Lenders Want Pre-Approval Done Right

Talk to any agent in Mt Eden, Ray White, and they’ll tell you the same story. Buyers with pre-approval have more chances of winning. And those without it? They just watch their dream homes slip away.

Pre-approval proves you’re serious about buying. It shows sellers you’ve financial backing. Most importantly, it tells you what you can afford before you fall in love with something too expensive. This prevents those later heartbreaks when you fell in love with a property but couldn’t buy it.

Step One – Get Your Financial House in Order

Don’t just show up at the bank. Before reaching there, do some homework. Your credit score matters a lot. Verify it through a reliable platform at your earliest convenience. A stronger credit history will help here. Many borrowers who apply successfully have scores in the “good” range (i.e., 650 to 750+). However, each lender has its own criteria.

If your credit score is in excellent standing, gather your documents. Lenders want proof of everything.

Here’s your essential document checklist:

- Last three months of payslips

- Two years of tax returns (if self-employed)

- Bank statements covering 90 days minimum

- Proof of deposit savings

- ID and proof of address

- Details of existing debts and expenses

Are some documents missing? That will slow the process down. So have them ready, both physically and digitally.

The Numbers Game Bank Actually Play

This is something most people usually miss. The banks scrutinise everything when it comes to mortgage preapproval. They don’t just look into your income. They calculate your debt-to-income ratio. They stress-test your budget against higher interest rates. They deeply scan your spending patterns as well.

Do you spend a mere $6 on that daily coffee? In their eyes, it accumulates over time and turns into a hefty $2,190 annually. Do you use Uber Eats three times a week? They might count that too.

You must clean up your spending for two to three months before applying. They want to see financial discipline.

Choosing Your Lender – Bank vs. Broker

The good thing here is that you have options.

Going directly to a bank can mean fewer choices since you’re limited to their specific products and rates. A broker, on the other hand, can compare multiple lenders to find the best fit for your situation. It’s often worth checking what a broker can offer first, then comparing it with your bank’s offerings.

The real comparison:

| Direct to Bank | Mortgage Broker |

| You deal with a single lender and a single interest rate. | Multiple lenders, competitive rates |

| You do all the legwork | Broker handles paperwork |

| Free service | Free to you (lender pays commission) |

| Limited product knowledge | Cross-market expertise |

Many Auckland buyers use brokers. They deal with the complexity while you can focus on house hunting. On top of that, brokers have relationships with lenders that often speed up approvals.

The Application Process Decoded

Done with the paperwork and budget? Now it’s time to apply.

Your broker or bank will run your information through their assessment system. They’ll verify everything. Employment gets checked. Income gets confirmed. Debts get validated.

The process takes anywhere from 24 hours to two weeks. Variables include how organised your documents are, whether you’re self-employed, and your current banking workload.

Speed up your process by responding immediately to any requests. Banks hate chasing applicants.

Understanding Your Pre-Approval Letter

You got it. Now what?

Your pre-approval states the maximum amount you can borrow and includes conditions. Read them carefully and patiently. Common conditions include property valuation, insurance confirmation, and final employment verification.

Important: Pre-approval typically lasts 90 days, but some banks offer six months. Should you not find a property by the expiry date, you will need to reapply and complete the process again.

Furthermore, you need to understand that pre-approval isn’t a guarantee. It’s conditional approval pending final checks when you make an offer.

Your Launchpad to Property Ownership

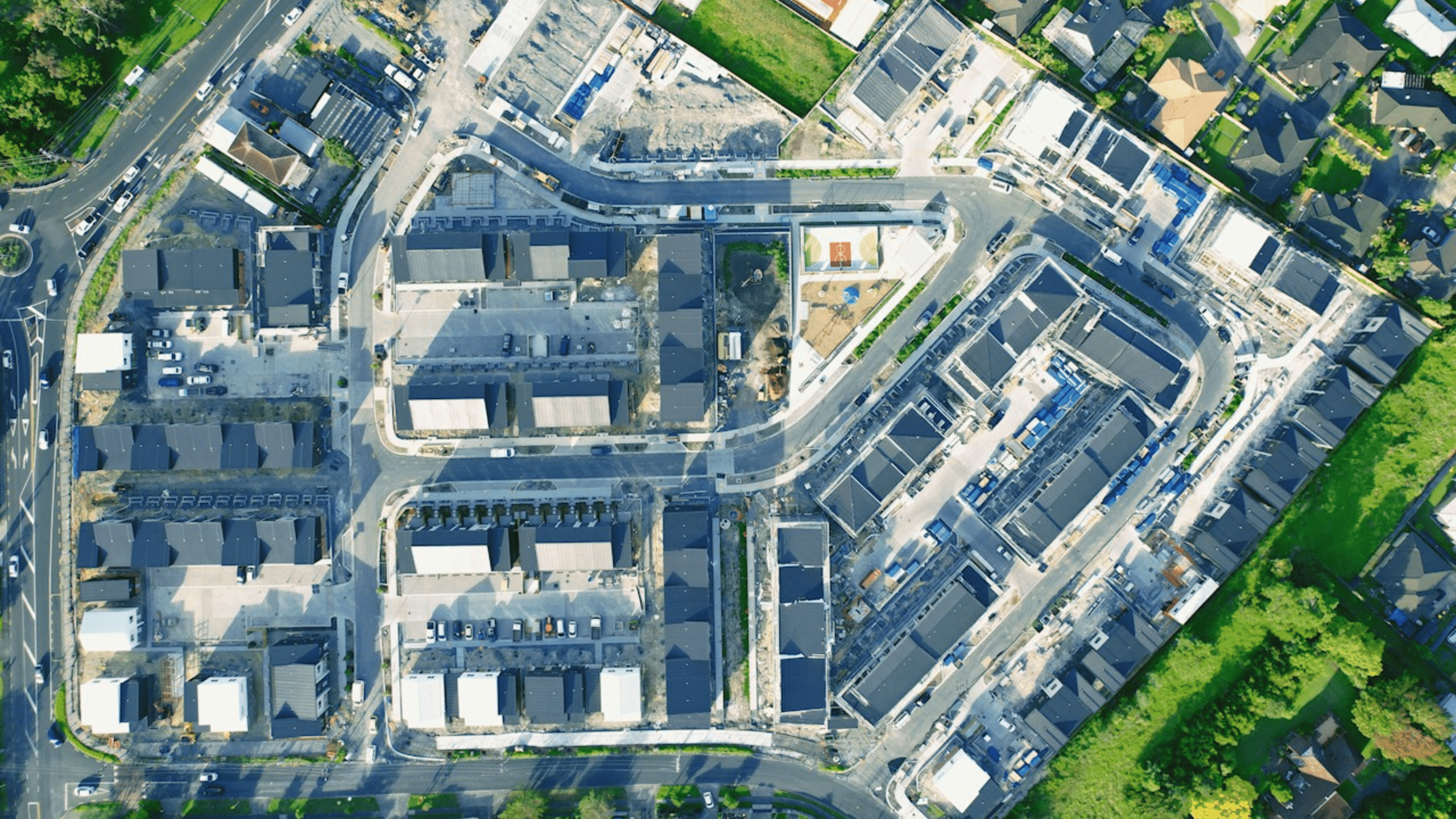

Pre-approval transforms you from browser to buyer. It gives confidence, clarity, and a competitive advantage in Auckland’s quick and exorbitant market.

Start gathering documents today. Choose your broker or bank tomorrow. Within two weeks, you could have that approval letter in hand.

Then the real fun begins—house hunting with actual buying power behind you.